REAL ESTATE &

MORTGAGE TERMS

Understanding Real Estate Terminology

The world of real estate is confusing for a number of reasons. While real estate agents deal with the process of buying and selling a home every day, the average person can get lost in all of the words and terminology that’s being tossed around. Stay in the loop with this simple guide on real estate slang phrases and terminology.

Real Estate Lingo

- Buyer’s Market: A Buyer’s Market is going to be ideal for someone who is looking to buy a house. This means there are plenty of homes for sale in the region in which they are looking. Therefore, there is a better chance of getting an amazing home for a low or fair price.

- Broker: A real estate broker is someone who has acquired their broker license and represents the seller or buyer of a real estate property.

- Closing: Closing is good news! Closing means ownership of a property has officially changed hands.

- Real estate agent: A real estate agent will be a state-licensed professional who can help you throughout the home buying and selling process.

- Realtor: A true realtor should be a member of the National Association of Realtors (NAR).

- Seller’s Market: A Seller’s Market describes a period where it is better to be someone selling one’s home rather than attempting to buy one. This usually is because there is a shortage of desirable homes to live in and there are too many potential buyers on the hunt for the right one. In turn, this can raise the prices of homes on the market.

- Subagent: A subagent is usually someone who assists another agent with whatever is needed at the time.

Real Estate Listing Terms

Appreciation: This is how much the home or property increases over time based on a few things such as home improvements, location, market fluctuation, and so on.

Open House: This one might be an obvious one but it is also a fun one! An open house is a perfect time for potential buyers to take a good look around a house that is available and on the market. Instead of scrolling online, you can visit the home in person and take a good look at what you like and don’t like about it. This would also be a good time to ask questions, view the surrounding neighborhood, and several other key aspects.

Turnkey: This term describes a home that is move-in ready, which includes furniture and appliances. This term also ensures that the overall structure of the home is in functioning order.

Mortgage Lingo

Adjustable-Rate Mortgage (ARM): Also known as a Variable Rate Mortgage, this program is a type of mortgage that has an interest rate that varies for however long the loan lasts depending on loan and rate index.

Amortization: This is the amount of loan debt that decreases over time. This is achieved through the repayment of the principal.

Annual Percentage Rate (APR): This is going to be the total cost of acquiring a loan including the yearly cost of a mortgage plus interest and other expenses.

Appraisal: An appraisal will come in the form of a written estimate of the property’s current value. It is a rough estimate of how much your home is worth. Mortgage lenders require that you get an appraisal before you sign on a home loan. The appraisal assures the lender that they aren’t loaning you more money than what your home is worth. Your lender may help you by scheduling an appraisal, done by an independent third party.

Assessment: An assessment is made to figure out the amount of property taxes that will be due.

Automated Underwriting System (AU/AUS): A mortgage lender may use this computerized system to approve your home loan.

Contract of Sale: A Contract of Sale will house all of your legal documents of the transaction including payment, settlement date, inspection requirements, and other important documents.

Debt-to-Income Ratio (DTI): This is the dollar amount of your monthly payments divided by your gross monthly income.

Earnest Money: This is a form of security made to a seller that can potentially buy their time to obtain financing, inspections, and other things before closing.

Equity: This is how much of the property or home the homeowner truly owns at the moment.

Escrow: This is the stage that comes before closing where the appropriate funds have been made and contracts are being held until the transaction can be completed by all parties.

Fair Market Value: A reasonable price that both the buyer and seller agree is fair according to the current market value.

Foreclosure: A foreclosure occurs when a property owner is unable or has not made the previously agreed-upon payments for their mortgage. Foreclosure times vary state-by-state but usually occur anywhere from two to three months after failed payments.

Homeowner’s Insurance: Homeowner’s insurance is essential and is a plan that covers the home in case of damages done due to weather, fire, vandalism, and many other reasons.

Listing Agent: This type of agent lists the available home on the regional Multiple Listing Service (MLS) and represents the seller throughout the selling process.

Loan to Value (LTV): This is the loan amount divided by the value of the property. This amount will be used to find your Principal, Interest, Taxes, and Insurance (PITI).

Lock and Float: A floating interest rate is subject to change, while a locked interest rate is set for a certain amount for however long your terms have outlined.

Multiple Listing Service (MLS): This is usually utilized by a group of brokers in order to see one another’s properties up for sale. They may also agree to share compensation among the homes listed.

Mortgage: Whenever a bank decides to lend you money, usually accompanied with some interest, you enter into an agreement known as a mortgage. Having a mortgage requires you to pay back the debt owed to the bank over a period of time.

Preapproval: Getting preapproved for a loan will depend on a few financial factors including employment, income, down payment, credit score, and possibly a few other forms of documentation. A preapproval is determined by these factors because it lets the bank know that you are reliable and trustworthy enough to make the payments owed.

Refinance: Many people refinance their homes to get a better interest rate, update their home, pay off their loan faster, get a fixed loan, and other reasons.

Underwriting (UW): An underwriter will likely be used to determine how much of a risk it believes you will be able to fulfill when it comes to a home loan.

8 Types Of Mortgages For All Home Buyers

Requirements To Get A Mortgage

In order to find the best mortgage for your prospective home, understand the types of loans you’re able to pursue. The factors below can influence the types of mortgages you’ll qualify for:

- Estimated down payment: The size of your down payment can impact the mortgage rate lenders will give.

- Monthly mortgage payment: Mortgage lenders will look at your income and assets to determine the total loan amount you can afford to pay back. When calculating your budget for your monthly mortgage payment, consider the principal amount, interest and taxes, mortgage insurance, utilities and any homeowner’s fees.

- Credit score: Your credit score will play a large role in determining the interest rate on your loan.

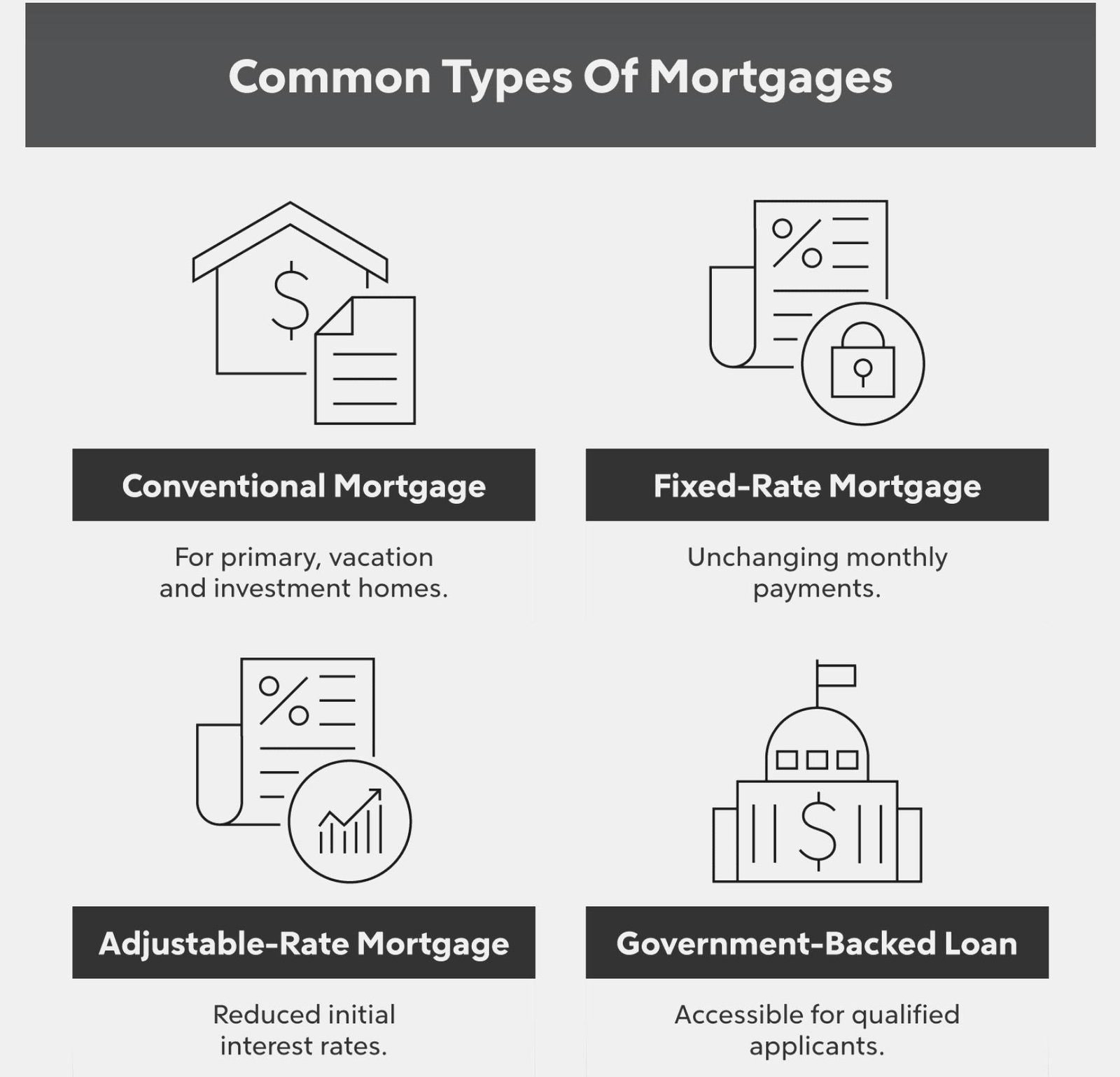

Types Of Home Loans

- Conventional mortgages

- Fixed-rate mortgages

- Adjustable-rate mortgages (ARM)

VS

- FHA loans

- USDA loans

- VA loans

- Jumbo loans

All types of mortgages are considered either conforming or nonconforming loans. Conforming versus nonconforming loans are determined by whether or not your lender keeps the loan and collects payments and interest on it or sells it to one of two real estate investment companies – Fannie Mae or Freddie Mac.

Conforming Loans

When you hear a lender talk about “conforming loan,” they’re using a mortgage term to refer to a conventional mortgage only. A conforming loan is one that can be purchased by Fannie Mae or Freddie Mac. For one of these institutions to purchase the mortgage from your lender, the loan must meet basic qualifications set by the Federal Housing Finance Agency (FHFA).

The basic criteria set by the FHFA include loans below a maximum dollar limit, loans that don’t already have backing from a federal government body and loans that meet lender-specific criteria.

- Below the maximum dollar limit: The maximum dollar limit in most parts of the contiguous United States is $548,250 in 2021. In Alaska, Hawaii and certain high-cost counties, the limit is $822,375. Higher limits also apply if you buy a multiunit home. Your lender can’t sell your loan to Fannie or Freddie and you can’t get a conforming mortgage if your loan is more than the maximum amount. Instead, you’ll need to take a jumbo loan to fund a home purchase above these limitations.

- Not a federally backed loan: The loan cannot already have backing from a federal government body. Some government bodies (including the United States Department of Agriculture and the Federal Housing Administration) offer insurance on home loans. If you have a government-backed loan, Fannie and Freddie may not buy your mortgage.

- Meets lender-specific criteria: Your loan must meet the lender’s specific criteria to qualify for a conforming mortgage. For example, you must have a credit score of at least 620 to qualify for a conforming loan. You may also need to take property guidelines and income restrictions into account when you apply for a conforming loan. A Home Loan Expert can help determine if you qualify based on your unique financial situation.

Conforming loans have well-defined guidelines and there’s less variation in who qualifies for a loan. Because the lender has the option to sell the loan to Fannie or Freddie, conforming loans are also less risky than jumbo loans. This means that you may be able to get a lower interest rate when you choose a conforming loan.

Nonconforming Loans

If your loan doesn’t meet conforming standards, it’s considered a nonconforming loan. Nonconforming loans have less strict guidelines than conforming loans. These loans can allow you to borrow with a lower credit score, take out a larger loan or get a loan with no money down. You may even be able to get a nonconforming loan if you have a negative item on your credit report, like a bankruptcy. Most nonconforming loans will be government-backed loans or jumbo loans.

Understanding Different Types of Mortgages

Depending on the type of mortgage applicant you are, you’ll find various advantages and disadvantages of home loans. Whether you’re a first-time buyer, downsizing or refinancing, consider the type of applicant you are before selecting a mortgage.

Conventional Mortgages

A conventional loan is a conforming loan funded by private financial lenders. Conventional mortgages are the most common type of mortgage. This is because they don’t have strict regulations on income, home type and home location qualifications like some other types of loans. That said, conventional loans do have stricter regulations on your credit score and your debt-to-income (DTI) ratio.

You can buy a home with as little as 3% down on a conventional mortgage. You’ll also need a minimum credit score of at least 620 to qualify for a conventional loan. You can skip buying private mortgage insurance (PMI) if you have a down payment of at least 20%. However, a down payment of less than 20% means you’ll need to pay for PMI. Mortgage insurance rates are usually lower for conventional loans than other types of loans (like FHA loans).

Conventional loans are a good choice for most consumers who don’t qualify for a government-backed loan or want to take advantage of lower interest rates with a larger down payment. If you can’t provide at least 3% down and you’re eligible, you could consider a USDA loan or a VA loan.

Pros Of Conventional Mortgages:

- The overall borrowing cost after fees and interest tends to be lower than an unconventional loan.

- Your down payment can be as little as 3% for qualifying loans.

Cons Of Conventional Mortgages:

- You have to pay PMI if the down payment is less than 20%.

- Stricter qualifications that require a minimum credit score of 620 and low DTI.

Home Buyers Who Might Benefit:

- Buyers with a stable income, at least 3% down, strong credit and employment.

Fixed-Rate Mortgages

A fixed-rate mortgage has the exact same interest rate throughout the duration of the loan. The amount you pay per month may fluctuate due to changes in local tax and insurance rates, but for the most part, fixed-rate mortgages offer you a very predictable monthly payment.

A fixed-rate mortgage might be a better choice for you if you’re currently living in your “forever home.” A fixed interest rate gives you a better idea of how much you’ll pay each month for your mortgage payment, which can help you budget and plan for the long term.

You may want to avoid fixed-rate mortgages if interest rates in your area are high. Once you lock in, you’re stuck with your interest rate for the duration of your mortgage unless you refinance. If rates are high and you lock in, you could overpay thousands of dollars in interest. Speak to a local real estate agent or Home Loan Expert to learn more about how market interest rates trend in your area.

Pros Of Fixed-Rate Mortgages:

- Monthly payments don’t change over the life of your loan, making it easier to plan a budget.

Cons Of Fixed-Rate Mortgages:

- You may end up paying more in interest over time if the rates are high in your area.

Home Buyers Who Might Benefit:

- Buyers that are purchasing or refinancing their forever home.

Adjustable-Rate Mortgages

The opposite of a fixed-rate mortgage is an adjustable-rate mortgage (ARM). ARMs are 30-year loans with interest rates that change depending on how market rates move.

You first agree to an introductory period of fixed interest when you sign onto an ARM. Your introductory period is typically 5, 7 or 10 years. During this introductory period, you pay a fixed interest rate that’s usually lower than market rates. After your introductory period ends, your interest rate changes depending on market interest rates. Your lender will look at a predetermined index to determine how rates are changing. Your rate will go up if the index’s market rates go up. If they go down, your rate goes down.

ARMs include rate caps that dictate how much your interest rate can change in a given period and over the lifetime of your loan. Rate caps protect you from rapidly rising interest rates. For example, interest rates might keep rising year after year, but when your loan hits its rate cap, your rate won’t continue to climb. These rate caps also go in the opposite direction and limit the amount that your interest rate can go down as well.

ARMs can be a good choice if you plan to buy a starter home before moving to your forever home. ARMs give you access to below-market rates for an initial introductory period. You can easily take advantage and save money if you don’t plan to live in your home throughout the loan’s full term.

These can also be especially beneficial if you plan on paying extra toward your loan early on. ARMs start with lower interest rates compared to fixed-rate loans, which can give you some extra cash to put toward your principal. Paying extra on your loan early can save you thousands of dollars later on.

Pros Of Adjustable-Rate Mortgages:

- Gives below-market rates for the initial introductory period.

Cons Of Adjustable-Rate Mortgages:

- If the rate increases, it can dramatically increase your monthly payments.

Home Buyers Who Might Benefit:

- Home buyers who are purchasing a starter home and don’t expect to live there for the loan’s full term.

Government-Backed Loans

Government-backed loans are insured by government bodies. When lenders talk about government-backed loans, they’re referring to three types of loans: FHA, VA and USDA loans. These loans are less risky for lenders because the insuring body foots the bill if you default. You may have more success getting a government-backed loan if you can’t get a conventional loan.

Each government-backed loan has specific criteria you need to meet in order to qualify along with unique benefits, but you may be able to save on interest or down payment requirements if you qualify.

Pros Of Government-Backed Loans:

- Possible to save on interest and down payments.

- Less strict qualification requirements than conventional loans.

Cons Of Government-Backed Loans:

- You must meet specific criteria to qualify.

- Many types of government-backed loans have insurance premiums that are required which can result in higher borrowing costs.

Home Buyers Who Might Benefit:

- Buyers who don’t qualify for conventional loans or have low cash savings.

FHA Loans

FHA loans are insured by the Federal Housing Administration. An FHA loan can allow you to buy a home with a credit score as low as 580 and a down payment of 3.5%. With an FHA loan you may be able to buy a home with a credit score as low as 500 if you have at least 10% down. Rocket Mortgage® requires a minimum credit score of 580.

USDA Loans

USDA loans are insured by the United States Department of Agriculture. USDA loans have lower mortgage insurance requirements than FHA loans and can allow you to buy a home with no money down. You must meet income requirements and buy a home in a suburban or rural area in order to qualify for a USDA loan. Rocket Mortgage® does not currently offer USDA loans.

VA Loans

VA loans are insured by the Department of Veterans Affairs. A VA loan can allow you to buy a home with $0 down and lower interest rates than most other types of loans. You must meet service requirements in the Armed Forces or National Guard to qualify for a VA loan.

Jumbo Loans

A jumbo loan is a loan that’s worth more than conforming loan standards in your area. You usually need a jumbo loan if you want to buy a high-value property. For example, you can get up to $2.5 million in a jumbo loan if you choose Rocket Mortgage®. The conforming loan limit in most parts of the country is $548,250.

Jumbo loan interest rates are usually similar to conforming interest rates, but they’re more difficult to qualify for than other types of loans. You’ll need to have a higher credit score and a lower DTI to qualify for a jumbo loan.

Pros Of Jumbo Loans:

- Interest rates are similar to conforming loan interest rates.

- You can borrow more for a more expensive home.

Cons Of Jumbo Loans:

- It’s difficult to qualify for, typically requiring a credit score of 700 or higher, significant assets and a low DTI ratio.

- You’ll need a large down payment, typically between 10 and 20%.

Home Buyers Who Might Benefit:

- Buyers who need a loan larger than $548,250 for a high-end home and have a good credit score and low DTI.

Balloon Mortgages

Less common mortgages are ones like balloon mortgages. On these types of home loans, you pay interest for a set period of time before a lump sum is owed. Oftentimes, you’ll make payments in a structure like a 30-year term for a short time, then at the end of the specified period, you’ll make a larger payment of the remaining balance. Another type of balloon loan is an interest-only mortgage where you only pay the interest each month until the end of the period when the principal is owed. Rocket Mortgage® does not offer these types of loans.

Pros Of Balloon Mortgages:

- You’ll have lower monthly payments of just interest or that’s partly amortized.

Cons Of Balloon Mortgages:

- Requires a large payment at the end of the term which is a higher risk for lenders and buyers.

Home Buyers Who Might Benefit:

- You’re a buyer in an area where home values are likely to rise and you only plan to live in the home for a short time, before the balloon payment is due.